Over the last year, DAT saw a very tight positive correlation between loaded import container volumes and load board load posts on the dry van spot market at all of the major U.S. ports.

It has been well documented that the huge hike in imported goods is being driven by American consumers eager to spend savings from travel, services and entertainment accumulated during lockdown.

The head of one of the largest U.S. gateways for trade said robust demand for imported goods likely will be sustained into 2022 as companies scramble to rebuild stockpiles during an uneven rebound from the pandemic.

Container ports from Seattle to Charleston, S.C., have posted record-high volumes this year, and many are so swamped with cargo that ships are forced into costly delays waiting for space to dock. The capacity strains have pushed ocean-freight rates to levels four times higher than they were before the pandemic.

At the top 10 ports, which accounts for 86% of total monthly container import volume in June, volumes were up 30% this year and down 12% this month. However, load posts increased 12% and spot rates increased by 5%. It’s important to note that part of the record May import volume will have been shipped by road in June given the length of delays being experienced at both Los Angeles ports.

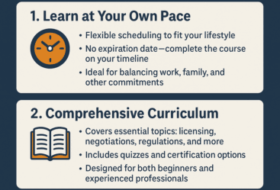

Growth + Change = Opportunity! How are you going to capitalize on the opportunity as a freight broker, agent, dispatcher or box truck carrier!?

Check out our courses for becoming a Freight Broker, Agent or Freight Dispatcher! As always reach out to us with any questions we are here to help 7 days a week!