As COVID-19 terrorizes the world this year, US history suffered the worst recession, and as days go by, economic condition recovers little by little. As this pandemic causes to influence the growth of the freight trucking market globally.

In a conference of investors from the various carriers they anecdote on the relative demand outperformance. Management from J.B. Hunt Transport Services (NASDAQ: JBHT) said they have seen incremental demand increases in each of the past six weeks. Schneider National also pointed out that a 10% – 15% plunge in tendered loads still leaves the carrier with more freight than it could haul.

Also, a change in the buying habits of the consumer that requires shipping has driven the spike in truck demand. According to the US Census Bureau, retail sales excluding motor vehicles reached $428 billion in August. The rapid change of market scenario and initial and future assessment of the impact covered in the research report. Most consumer spending fell about 20% in April but has spiked back to 4.5% off pre-COVID-19 levels from January. Spending on products such as cars and auto parts is now above January levels as spent on furniture, appliances, and other house goods.

A thorough analysis in the Freight Trucking Market provides a forecast period from 2020 – 2026 on the market based on types and applications. This report also includes investment opportunities and probable downfall and as it also focused on the market of Freight. The objectives of this study are keynoting the development of the market across the globe.

Key Highlights from Freight Trucking Market Study composed of Income and Sales Estimation, Assembling Analysis, Competition Analysis, and Demand and Supply Effectiveness. These analyses were thoroughly broken down to understand the keys on how the Freight Trucking Market bounced back despite this pandemic.

In a word, This market provides major statistics that with a proper valuable source of guidance and direction these will raise the growth of the business.

Several headwinds face truck capacity. An oversupplied truck market and cost inflation, including a jump in insurance premiums, led to a high number of carrier bankruptcies and a low level of new truck orders in 2019.

While new truck orders have improved recently, many don’t believe they are keeping pace with replacement as banks have tightened lending requirements for many carriers. Net Class 8 truck orders were 19,400 in August, according to ACT Research, 5% lower than July but 74% higher year-over-year. This was the third time since December monthly orders were near 20,000 units, a level seen by most as the least required to replace retiring equipment and keep the entire industry fleet from declining.

At a forecasting webinar last week, ACT Research said they expect orders to ramp further as truck-buying enters a strong point in the year. “July and August were the two best months since the fourth quarter of 2019,” said Kenny Vieth, ACT Research president, and senior analyst. “We should be seeing [monthly] orders in the fourth quarter of the 25,000-26,000 average.”

Morgan Stanley (NYSE: MS) analyst Ravi Shanker provided some resistance in a note to clients, saying the August result came in lower than ACT Research’s implied forecast of 21,000 units, which “indicates signs of recent order momentum slowing.” He expects “supply headwinds to persist moving forward” and doesn’t expect “a sharp influx of supply.”

In its August report, cargo information and examination firm FTR Transportation Intelligence said it anticipates that requests should stay in the “20,000 territory for the following not many months.” The firm said that the enormous fleets are proceeding to purchase yet at levels just in accordance with ordinary substitution cycles and that a couple of requests have been for fleet development.

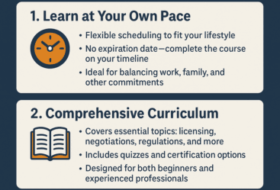

U.S. Xpress accepts the gracefully deficiency is probably going to wait and that driver wage increments in the 15% to 20% territory are needed to get the quantity of drivers expected to satisfy need. The organization accepts this shipping cycle could run longer than the verifiable normal of six to eight quarters. So if you have been waiting for a sign to get into the freight industry, it is here! Check out our courses for becoming a Freight Broker, Agent or Freight Dispatcher! As always reach out to us with any questions we are here to help 7 days a week!